Reducing liability during COVID-19

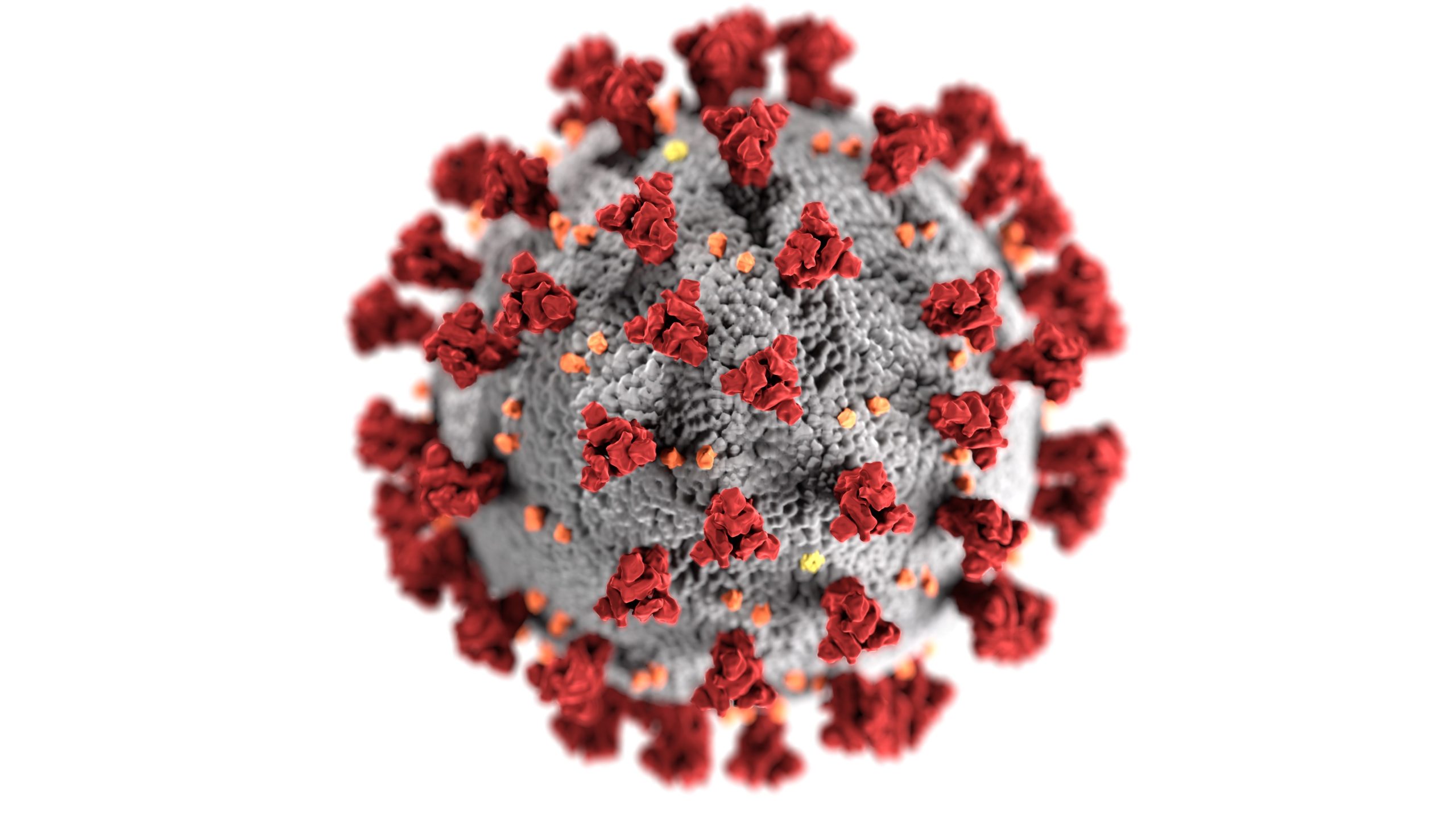

What a unique situation we find ourselves in. Just a few weeks ago, our spirits were up and we were celebrating continued prosperity of our region, but today, we find ourselves in an uncertain world with COVID-19, the modern pandemic, taking lives by the thousands.

While start-ups around the world are grappling with gruesome decisions around sustainability, cash-flow, and survival in time of crisis, local leaders are demonstrating strength of character as they remain calm and lead with dignity.

In times like these it is especially important to remember that an employer’s main responsibility is to provide a safe and healthy work environment. We are already seeing advertising about how to sue your employer. You are going to be judged by every decision that you make today.

On March 18, President Trump signed House BIll 62.01 into law. The mandates focus on three items with regard to People Operations.

- Paid Leave

- Family Medical Leave Act (FMLA)

- Unemployment Insurance

The mandates are a reaction to COVID-19 and are set to expire on December 31, 2020.

Paid Leave

Companies with under 500 employees are now required to offer two weeks of paid leave for part-time and full-time employees, who are unable to work or work remotely, if:

- Advised by a doctor or government to self-quarantine

- Experiencing symptoms and seeking diagnosis/treatment for COVID-19

- Caring for a family member who is sick with COVID-19

- Caring for kids under age 18 whose schools are closed and no childcare is available

Employees are to be compensated at the higher of their regular rate of pay, the federal minimum wage, or the local minimum wage, but not to exceed $511 per day and $5,110 in total.

However, if an employee must care for a sick family member, a child who is unable to attend school, or because they meet the criteria for “similar conditions,” then they are to be paid two thirds of the rate of their regular rate of pay, but not to exceed $200 per day and $2,000 in total.

Each quarter, private sector employers are entitled to a tax credit equal to 100% of the qualified sick leave wages paid.

The payments made under these mandates are not considered wages for Social Security payroll tax purposes.

Start-ups with under 50 employees are considered small employers under the law and may be exempt from this mandate if they can show that paying out said PTO will result in shutting down the business. The Department of Labor (DOL) will come out with regulations that will guide you on how to seek exemption.

Healthcare and emergency workers are also exempt, meaning that you can require them to be at work.

Family Medical Leave Act (FMLA)

The existing FMLA that applies to employers with over 50 employees in a 75 mile radius remains: your employees can take up to 12 weeks of unpaid time off to take care of themselves or a family member. Small employers under 50 employees now have to pay attention to FMLA in a limited way.

Effective immediately, all private sector employers with less than 500 employees must provide 12 weeks of paid FMLA leave. To be eligible the employee must have worked for the company for more than 30 calendar days. Leave must be provided in order to care for children under age 18, if and when: a) schools are closed or daycare is unavailable because of the current emergency and b) the employee is unable to work or work remotely. (This would not apply if you can work remotely with screaming kids in the background.)

After 10 days (or what would likely be the equivalent of the paid sick leave mandate as summarized above), an eligible employee would be entitled to additional pay under said FMLA at the rate of two thirds of his or her regular rate of pay.

The caps are $200 per day and $10,000 in total.

Tax credits will be available to cover 100% of employer’s cost.

Again, if you are under 50 employees, you may be exempt. More details from DOL forthcoming.

Unemployment Insurance

The federal government has expanded the thresholds for Unemployment Insurance and is encouraging local governments to be more flexible.

Michigan’s Governor Gretchen Whitmer signed Executive Order 2020-10 to temporarily expand eligibility for unemployment benefits.

Now, workers who lost their jobs through layoffs or voluntary terminations due to inability to work for COVID-19 related reasons (whether caring for self or a family member), will be eligible for up to 26 weeks of Unemployment Insurance coverage.

If the individual is able to continue to work or work remotely, but chooses to resign due to fear of becoming infected with COVID-19, while the employer is taking correct precautions to protect their employees, it is unlikely that benefits will be granted.

Anyone can apply. If fact, it is good practice for employers to encourage departing employees to apply for Unemployment Insurance. The determination will be made by the State.

Most Unemployment Insurance claims will add up to result in higher State Unemployment Tax (payroll tax) for employers, so contesting your claims in a timely manner, where necessary, continues to be an important internal practice.

Being a leader is hard as it is and here is yet another test. Can we stay human, save face, and do what’s best for the bottom line in time of crisis? Today, especially, our main job is to do everything possible, in light of our means, to reasonably provide a safe and healthy workplace. Anyone who will deviate from this will find himself with liability in no time.